Energy performance rating deadline

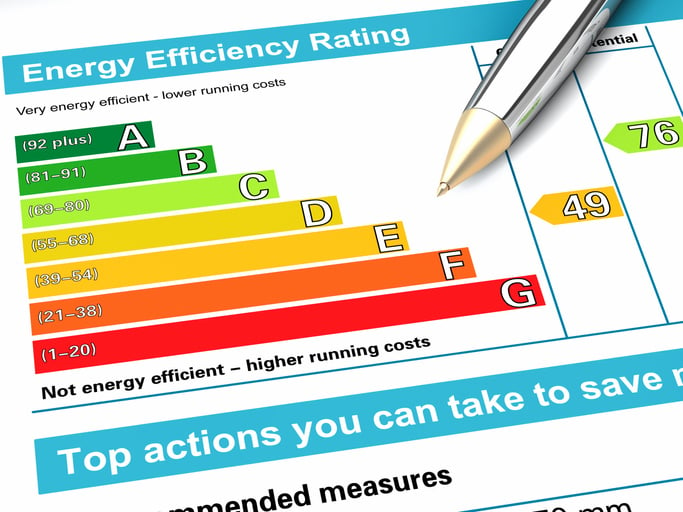

You’ve probably already heard the news - EPC legislation is changing. From 2025 new tenancies must achieve a minimum rating of a C.

In May last year Rightmove reported that nearly 60% of available rental properties on their portal still had an EPC rating below C.

This means there's a lot of work ahead to get every property up to standard by the 2025 deadline for new tenancies. Landlords waiting to the last minute to bring up their rating will end up with some heavy competition in the race for contractors.

This is all to say that it’s time to start planning now. Low-energy lighting, insulation, and window improvements are all things you can focus on to meet the deadline and beat the queues.

We've also found that an increasing number of residents are searching for 'energy efficient' properties' to try to cut their bills and avoid the pinch. So not only will these improvements keep you compliant, they'll make your property more attractive to renters.

Expanding licensing schemes

2022 saw property licensing schemes expand to take over several London boroughs, including Barnet and Haringey. This year so far Ealing and Newham have joined in to implement property licencing schemes.

Other boroughs still have either added to the schemes they have in place, including Kensington & Chelsea, or are in active consultation, like Greenwhich and Brent.

We don’t expect it to stop there; as the government tries to crack down on rogue landlords, we expect more licensing expansions to be implemented. Kamma, a tech suite with a host of property profiling products, predicts that over 525 schemes will be live in England and Wales by July 2023.

If your property is managed by Paramount, we'll take care of any licencing requirements that affect your property if and when they come into place.

If you have properties in your portfolio that we don't manage , make sure you're aware of any changes that might be coming into play in your borough. The fines for non-compliance are hefty - up to £30,000 in some cases. According to Kamma, Camden is the top enforcer.

Rental demand is growing

It's fair to say that last year the rental market was massively busy, and we think it will continue that way. We’ve seen the demand for rental properties in London remain relatively high this January, with an average of just over 50 enquiries per property.

With mortgage rates still high compared to the last few years, and a higher cost of living being felt by all, we expect that many who were hoping to buy their first property will choose to wait.

They'll remain in the rental market - those who aren't living at home - and wait for more favourable mortgage rates to become available. This means even more demand for quality rental property.

That being said, the increased cost of living is also a reason landlords should be considering a rent recovery policy for their investment.

While we do everything in our power to ensure residents meet our strict affordability criteria, changes in living situation can be unexpected and severely affect a resident's ability to pay rent.

Last year two of our landlords had residents who fell into arrears, and one of them entered a Breathing Space (a debt respite scheme introduced during covid). This meant we couldn't chase their arrears for up to 60 days.

The combined arrears for both properties totalled £8790, but because both landlords had a rent recovery policy, they didn't lose their income.

We encourage all landlords to consider a rent recovery policy because it's both affordable and protects you against a signficant financial loss. If you're not already covered, 2023 is the perfect year to sign up!

Capital gains tax allowance changing

Has the thought crossed your mind to sell your buy-to-let investment? Last November The Treasury announced changes to the tax-free allowance for capital gains tax, which currently sits at a rate of 28% for private landlords.

This means landlords will have to pay more tax on their profits from selling a buy-to-let property. The tax-free allowance will drop this April from the current £12,300 to £6,000, and then it will drop again to £3,000 in April 2024.

We can't stress enough how important it is to really consider your options before selling. Why did you buy the property in the first place? Have you looked at all of your options to retain it?

In our experience nearly all landlords thinking of selling decide to keep their property after speaking to us - and not because we're just really persuasive. It's because there are many options out there that they simply haven't considered. You can read our blog here for more on that!